Easton's Investments: Back to BasicsThe pharmaceutical and venture capital industries have tried to reduce risk by focusing too significantly on “me too” companies. This strategy has failed to reduce risk and bring new products to market. That is why we at Easton make it our mission to get back to basics by focusing both on innovation in healthcare and the life sciences, but also on insuring that our portfolio companies develop reasonable and lean business models; we partner only with entrepreneurs able to create successful and sustainable companies.

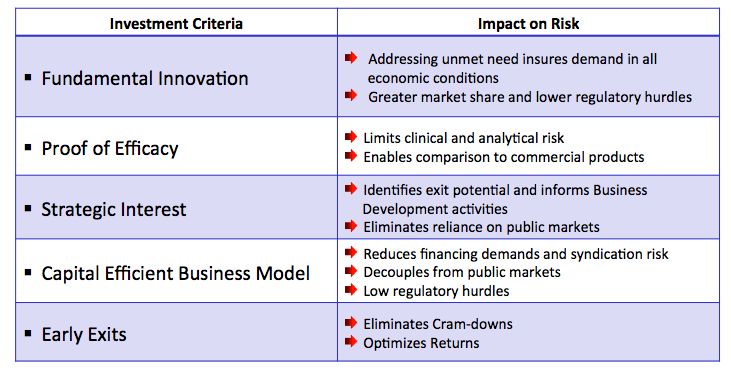

We look for companies in the healthcare sector with products that will provide a solution to previously unsolved problems. Historically, Easton has found success in investments made in drugs, diagnostics, devices, and healthcare services that all fulfill fundamental needs in the industry. Below, read further about what Easton looks for in a successful investment: |